Trump’s First 100 Days: Stock Market Turmoil and the Worst-Performing Stocks

Trump’s First 100 Days: Stock Market Turmoil and the Worst-Performing Stocks - President Donald Trump’s first 100 days back in the White House have been marked by significant volatility in the stock market.

Since his inauguration on January 20, 2025, investors have faced mounting uncertainty triggered by potential new tariffs and proposed cuts to federal government spending.

These policy moves have heightened caution among market participants, leading the S&P 500 index to post what is projected to be the worst 100-day performance by a sitting president since Richard Nixon’s second term in the 1970s.

Despite the overall pressure on major indexes, several individual stocks have shown extreme fluctuations — with a few even managing to post notable gains.

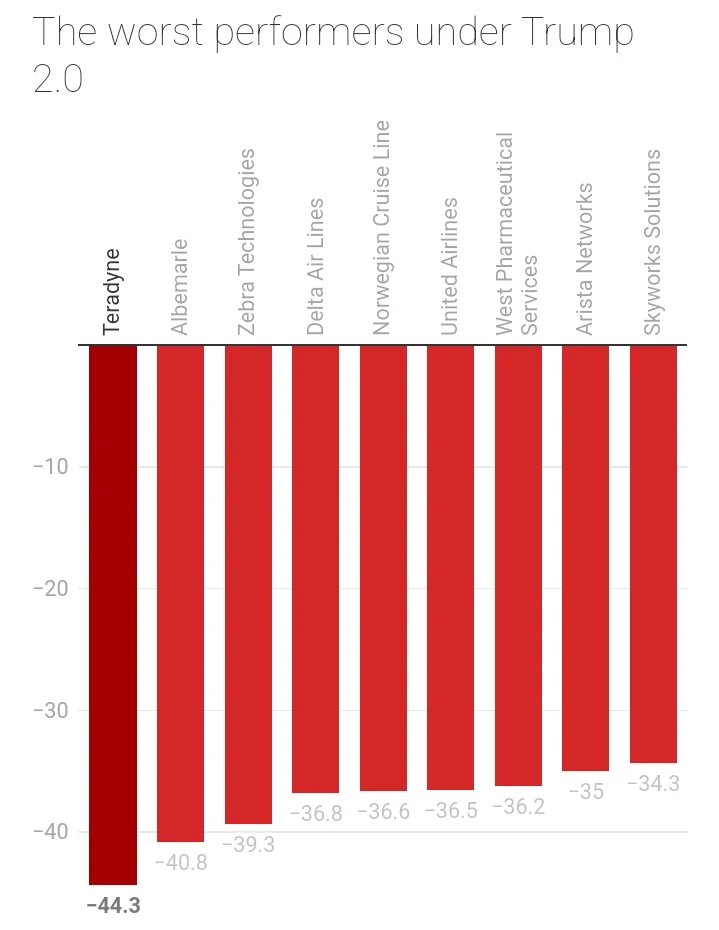

In an effort to track these movements, CNBC International conducted an analysis of stocks within the S&P 500.

Using the closing prices from the last trading day before Trump’s inauguration, they identified both the best- and worst-performing stocks during Trump’s first 100 days back in office.

This analysis highlights the stocks that have struggled the most, reflecting the impact of political uncertainty on investor sentiment across US financial markets.

Deckers Outdoor Leads S&P 500 Decline as Airline and Retail Stocks Struggle

Deckers Outdoor faced a steep drop in the S&P 500, with shares plunging 48% over the recent period.

The maker of popular brands like Ugg and Hoka came under heavy pressure amid growing investor concerns about Donald Trump's proposed tariffs on imported goods.

Evercore analyst Jesalyn Wong noted that much of Deckers' production is likely based in China and Vietnam, making the company especially vulnerable to trade policy shifts.

The airline sector also took a hit, with Delta and United Airlines both seeing their stocks tumble by more than 36%.

Weakening consumer confidence and rising fears of an economic downturn fueled doubts about the sector's near-term outlook.

In response to softening demand forecasts for the second half of the year, airlines have begun offering aggressive discounts to stimulate ticket sales.

Despite the recent turbulence, Wall Street analysts remain optimistic. According to LSEG data, most analysts maintain a "buy" rating on these stocks, projecting potential price gains of over 30%.

While some sectors struggled, a few companies soared.

Palantir Technologies led the gains within the index, with its stock surging more than 57%. The defense tech firm has continued its strong performance from last year and appears well-positioned under a new administration promoting deregulation, operational efficiency, governance, and transparency—an agenda summarized by the acronym DOGE.

During Palantir’s February earnings call, Chief Technology Officer Shyam Sankar stated that these principles align closely with the company's commercial mission.

Netflix also stood out with a stock price increase of more than 28%. The streaming giant’s business model, which relies less on international supply chains, helped insulate it from tariff-related market volatility.

Meanwhile, some defensive stocks also posted impressive returns.

Tobacco giant Philip Morris rose around 40%, while telecommunications company AT&T saw gains exceeding 20%, demonstrating that certain sectors can still provide stability in an uncertain market environment.